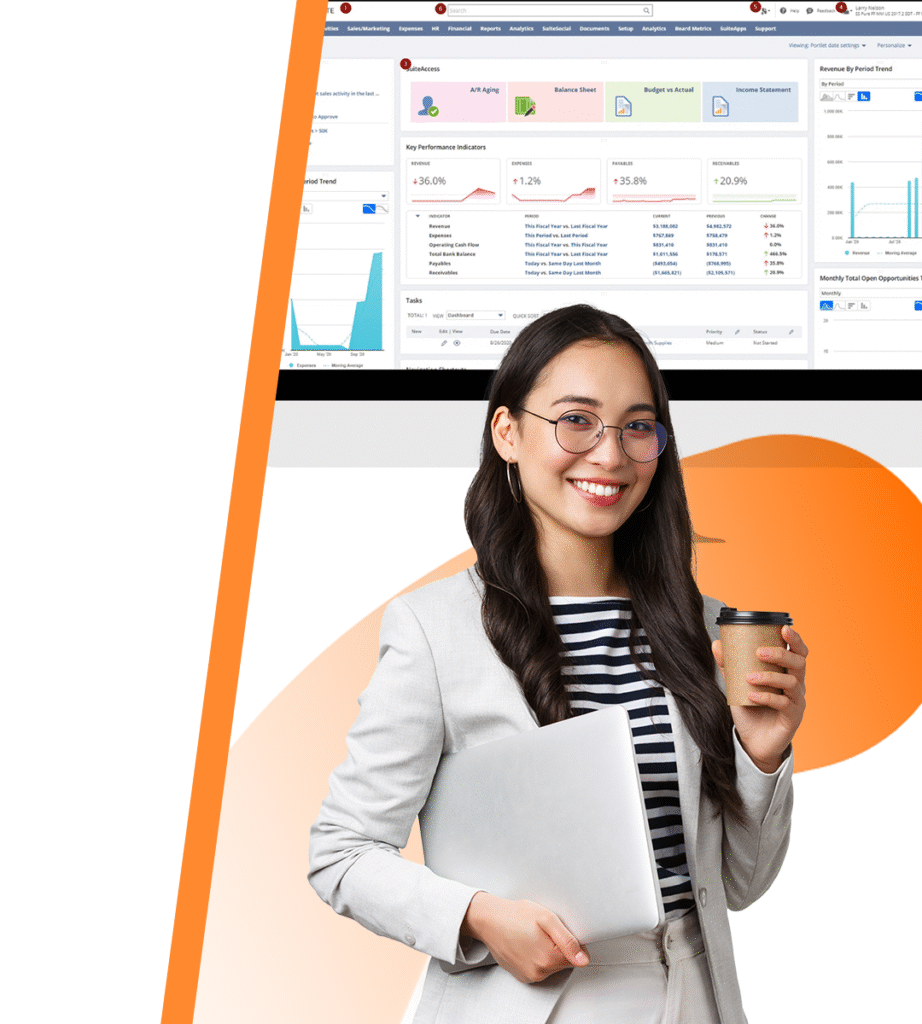

Oracle NetSuite

Accounting and Financials: Drive Growth Through Smarter Financial Management

Reduce errors, ensure compliance, and scale confidently with BIR-Ready computerized accounting system.

Manage your financial process efficiently

Oracle NetSuite provides a unified platform that integrates core financial functions, such as general ledger, accounts payable, accounts receivable, cash management, and financial consolidation. It enables businesses to automate routine tasks, improve accuracy, and gain real-time visibility into their financial data.

NetSuite’s Financial and Accounting is a core component of the NetSuite Enterprise Resource Planning (ERP) system, which offers a wide range of financial management and accounting tools to help businesses streamline their financial processes and gain real-time insights into their financial health.

In addition, organizations can efficiently manage financial processes across multiple subsidiaries, locations, and currencies. It supports global financial operations by providing multi-currency management, tax compliance, and localization capabilities.

Oracle NetSuite Financial Management and Accounting

Chart of Account Creation and Maintenance

This feature allows for the creation and management of a structured list of all financial accounts used by the organization. It enables the definition of account types, hierarchies, and segments for detailed financial tracking and reporting. Users can customize the chart of accounts to align with specific business needs and reporting requirements, ensuring accurate categorization and analysis of financial transactions.

Profit / Cost Centers

This functionality allows organizations to define and track financial performance at the departmental, project, or location level. By assigning transactions to specific profit or cost centers, businesses can analyze profitability, identify areas of cost overrun, and make informed decisions about resource allocation and operational efficiency

General Ledger

The general ledger serves as the central repository for all financial transactions. It provides a comprehensive record of debits and credits, categorized by account.

Trial Balance

This feature generates a report that lists all general ledger accounts and their balances. It serves as a critical tool for verifying the accuracy of the accounting records by ensuring that total debits equal total credits. The trial balance is a key step in the financial close process.

Accounts Payable (AP) Aging

This function provides a detailed analysis of outstanding liabilities owed to vendors, categorized by the length of time they are overdue. It helps businesses manage cash flow, prioritize payments, and avoid late payment penalties. It also provides insights into vendor relationships and potential payment risks.

Accounts Receivable (AR) Aging

Tracks outstanding receivables owed by customers, categorized by the length of time they are overdue. It helps businesses manage collections, assess credit risk, and improve cash flow. It also provides insights into customer payment patterns and potential bad debt.

Financial Statements

Generates key financial reports, including the balance sheet, income statement, and cash flow statement. These reports provide a comprehensive view of the organization’s financial performance and position, enabling informed decision-making and compliance with reporting requirements.

Accruals and Reversals

This feature supports accrual accounting by allowing the recognition of revenue and expenses in the period they are earned or incurred, regardless of when cash is exchanged. Reversals ensure that accruals are properly adjusted in subsequent periods, maintaining the accuracy of financial statements.

Cash Advances, Liquidations, Petty Cash and Reimbursements

Streamlines the management of employee cash advances, petty cash disbursements, and expense reimbursements. It provides controls and audit trails to ensure proper authorization, tracking, and reconciliation of these transactions.

Journal Entries

Recording of individual financial transactions in the general ledger. It supports both manual and automated journal entries, ensuring accurate and complete financial records. Users can create, review, and approve journal entries, maintaining data integrity and compliance.

Bank Reconciliation

Automates the process of comparing and reconciling bank statements with internal accounting records. It identifies discrepancies, ensures accurate cash balances, and helps prevent fraud.

Period Management

Controls the opening and closing of accounting periods, ensuring that transactions are recorded in the correct period and preventing unauthorized changes. It supports the financial close process and ensures the integrity of financial data.

Budget vs. Actual

Enables businesses to compare actual financial performance against budgeted amounts. It provides insights into variances, enabling better financial planning and control. Users can analyze budget vs. actual reports to identify areas of improvement and make informed decisions about resource allocation.

BIR Tax Reports

Generates reports required for tax compliance with the Bureau of Internal Revenue (BIR) in the Philippines. It ensures accurate and timely tax filings, helping businesses avoid penalties and maintain compliance with tax regulations.

BIR-Accredited Solution

The Philippines’ Bureau of Internal Revenue, detailed in BIR Revenue Regulation No. 09-2009, outlines the obligations and responsibilities for Filipino taxpayers. This regulation focuses on using electronic systems, particularly the Computerized Accounting System (CAS), for maintaining accurate records and books of accounts. For larger taxpayers, adherence to this regulation has been mandatory since January 2010. Essentially, it mandates that all companies comply with BIR accounting standards, necessitating the use of BIR-certified systems for their operations.

Cloudtech plays a crucial role in assisting organizations to adhere to tax regulations. It eliminates the need for companies to manually keep track of BIR requirements, as this becomes an integral part of the services offered by Cloudtech. By providing BIR-certified solutions, Cloudtech ensures that the accounting processes within a company are not only efficient but also compliant with the set regulations. This assurance of regulatory compliance offers companies peace of mind, ensuring alignment with government standards.

Cloudtech’s assistance in maintaining tax compliance for businesses signifies a proactive approach to managing accounting procedures. By using Cloudtech’s BIR-certified products, companies can confidently navigate the complexities of tax regulations, knowing that their systems are aligned with the stipulated standards. This proactive approach not only streamlines operations but also safeguards companies against potential regulatory issues, fostering a culture of compliance and efficiency within the business landscape.

“CloudTech provided tailored training and comprehensive documentation. They helped us set up customized reports, address compliance, and fine-tune audit trails.”

Bienvenido Oropeza III – Accounting and Systems Director

FAQs ABOUT ORACLE NETSUITE

WATCH THE RECAP!

Access the recap video of our webinar session and and gain expert insights, real-world examples, and actionable tips for IT teams looking to optimize their operations.

Explore other Oracle NetSuite Solutions

Oracle NetSuite offers a variety of solutions tailored to meet the specific requirements of different industries, functions, and business needs.

Procurement

Effectively manage vendor Relationships, source-To-Pay processes and control Spend.

Healthcare and Clinic Services

Optimize Healthcare Processes and Manage Patient Records efficiently.

Contact Us

Fill up the form and we will contact you immediately

Get in Touch

Your system requirements are important to us! Call us to schedule a consultation and get faster assistance.

Phone Number

09171069478

inquire@ogis-cloudtech.com

Map Street

Download Datasheet

Download Datasheet